Manganese X Energy Corp. (MXE) Announces Mineral Resource Estimate for Battery Hill Manganese Project

- 86 Million tonnes of Measured and Indicated Resources grading 6.42% Mn; plus

- 91 Million tonnes of Inferred Resources grading 6.66% Mn

Highlights:

- The mineral resource estimate utilizes a 2.5% Mn cut-off grade that reflects total operating costs having “reasonable prospects for economic extraction.”

- Operating costs applied in the pit optimization reflect an innovative processing flow sheet designed by Kemetco Research.

- Kemetco will be applying for a Provisional Patent on behalf of the Company to protect this process. The process focuses on production of 99.95 % High-Purity Manganese Sulphate Monohydrate (HPMSM) for the electric vehicle (EV) and back up energy storage sectors. The HPMSM will be devoid of selenium, the bane of some 98% of current producers.

- Based on the large inventory of Measured and Indicated mineral resources defined to date, MXE will move quickly to acquire all information required to bring the project to a Feasibility Study stage.

- Current focus is on the HPMSM market. The Company also anticipates potentially recovering lower grade Mn to produce additional products such as those used in the agricultural industry.

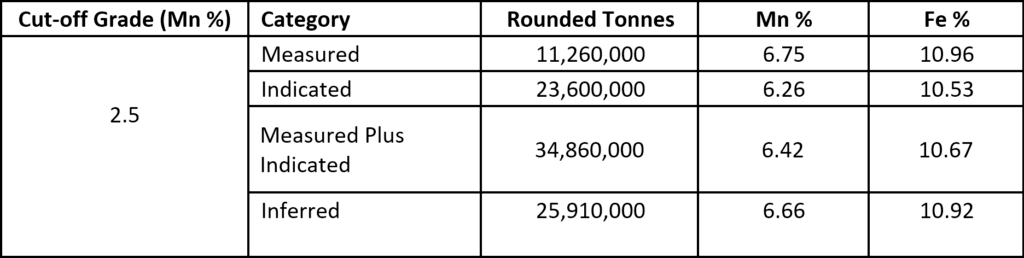

Montreal, Quebec, Canada, July 7, 2021- Manganese X Energy Corp. (TSXV:MN) (FSE: 9SC2) (OTC: MNXXF) (“Manganese” or the “Company”) is pleased to announce the first Mineral Resource Estimate for its Battery Hill Manganese Project of 34.86 million tonnes of Measured and Indicated mineral resources grading 6.42% Mn, plus an additional 25.91 million tonnes of Inferred mineral resources grading 6.66% Mn. The mineral resource estimate was prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and is tabulated in Table 1.

Table 1: Battery Hill Deposit Mineral Resource Estimate – Effective Date June 18th, 2021

Mineral Resource Estimate Notes:

- Mineral resources were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (MRMR) (2014) and CIM MRMR Best Practice Guidelines (2019).

- Mineral resources are defined within an optimized pit shell with average pit slope angles of 45⁰ and a 3.7:1 strip ratio (waste : mineralized material).

- Pit optimization parameters include: pricing of US$1500/tonne for High Purity Manganese Sulphate Monohydrate – 32% Mn (HPMSM – 32 %), exchange rate of CDN $1.30 to US$ 1.00, mining at CDN $6.50/t, combined processing and G&A (1000 tpd) at CDN $86.22/t processed and a process recovery of Mn to HPMSM of 65%. Fe content was not included in the pit optimization.

- Mineral resources are reported at a cut-off grade of 2.50 % Mn within the optimized pit shell. This cut-off grade reflects total operating costs used in pit optimization to define reasonable prospects for eventual economic extraction by open pit mining methods.

- Mineral resources were estimated using Ordinary Kriging methods applied to 3 m downhole assay composites. No grade capping was applied. Model block size is 5 m (x) by 5 m (y) by 5 m (z)

- Bulk density was applied using a regression curve based on Mn % and Fe % block grades.

- Mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Mineral resource tonnages are rounded to the nearest 10,000.

Martin Kepman, CEO of the Company, states “This is game changing news for the Company, having such a large resource totalling 34.9 million Measured and Indicated tonnes and 25.9 million Inferred tonnes underwrites the project’s long-term potential for supply of manganese. In addition, our ongoing metallurgical testing is making great strides toward achieving an economically optimized extraction process. We look forward now to the completion by Wood Canada Ltd. of a Preliminary Economic Assessment (PEA) for the project that will incorporate this new mineral resource estimate plus the latest metallurgical developments to provide important insight into the economic viability of producing high purity manganese sulphate from our Battery Hill deposit. We are buoyed by the knowledge that, with a positive outcome from the PEA, there appears to be sufficient tonnage of Measured and Indicated mineral resources to potentially sustain long term production while we explore the potential of the other Mn mineralization on our 1228-hectare property. The EV revolution is well underway and innovative battery chemistry is a large part of the disruption. We believe manganese will have a large influence over EV batteries going forward. Our Battery Hill property could potentially have a long-life cycle, estimated at 25 years based on the Measured and Indicated Resource, and potentially service the EV sector for years to come within the North American and European supply chain”

The Company has undertaken several core drilling programs over the past 5 years that support the current mineral resource estimate. These include 53 holes totaling 9,697 metres over a deposit strike length of approximately 2.0 kilometres to arrive at this point. A diamond drilling program is being planned to expand Measured and Indicated mineral resources and to explore other known Mn showings on the 7 kilometer long MXE property.

The associated mineral resources now defined form the basis of the PEA being prepared by Wood Canada Ltd. The PEA will characterize and assess Commercialization and Economic Viability Potential for a future mining and processing operation at the Battery Hill Property.

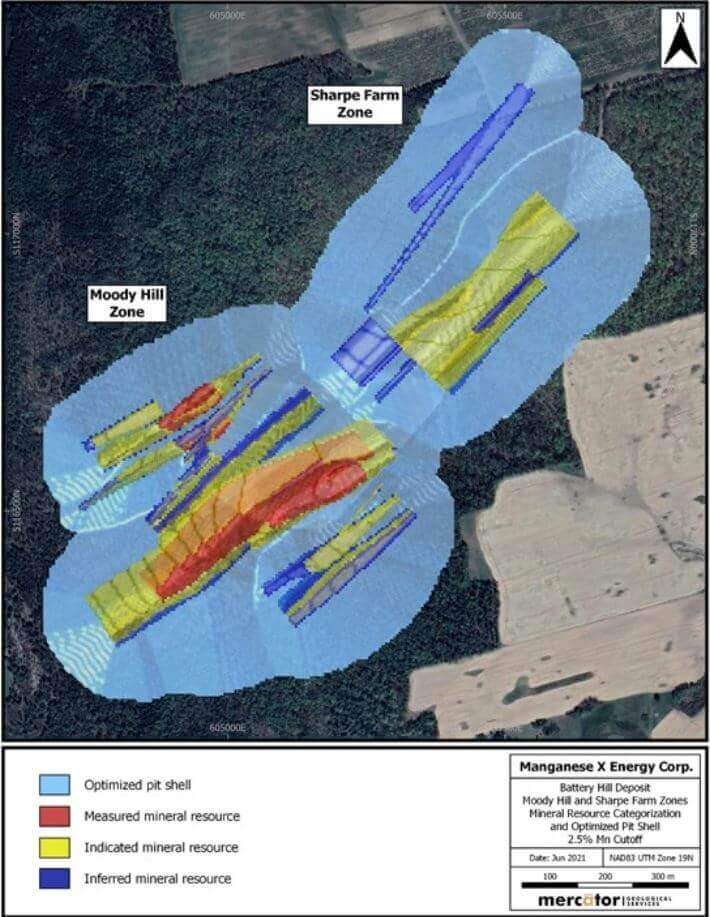

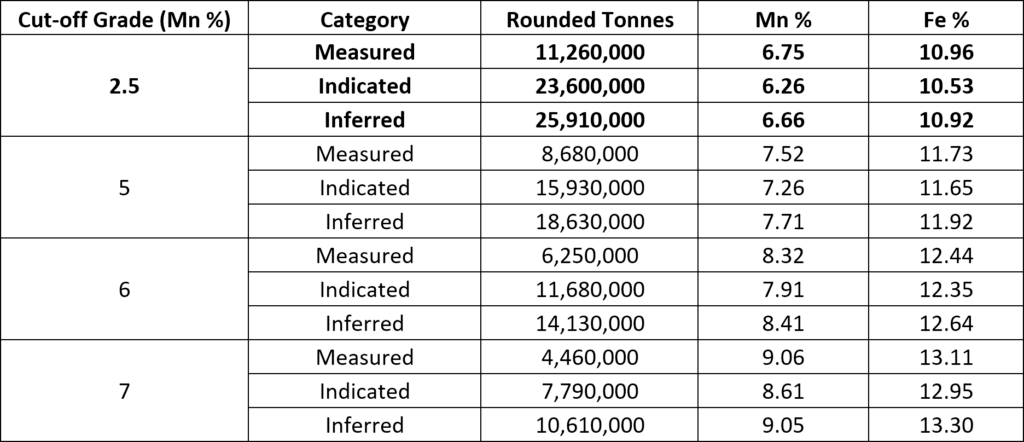

The Battery Hill Deposit is comprised of the Moody Hill, Sharpe Farm, and Iron Ore Hill Zones. On a contained tonnage basis the Moody Hill, Sharpe Farm, and Iron Ore Hill Zones comprise approximately 56%, 29%, 15%, respectively, of the Battery Hill Deposit mineral resource. The Moody Hill and Sharpe Farm Zones, just a few hundred meters apart (see Map, Figure 1), contain all of the Measured and Indicated mineral resources for the Battery Hill Deposit. The grade/tonnage sensitivity analysis that appears in Table 2 provides insight into the character of Mn mineralization present within the Battery Hill Deposit over the cut-off grade range of 2.5% Mn to 7% Mn. Although iron (Fe) content has also been estimated and is currently reported for the deposit, only manganese content was used in the pit optimization process. The Company will further assess Fe by-product opportunities through future metallurgical studies.

Table 2: Tonnage/Grade Sensitivity Details (Pit Shell Constrained) for the Battery Hill Mn Deposit

Note: This table shows sensitivity of the June 15, 2021 Battery Hill deposit mineral resource estimate to cut-off grade. The base case at a cut-off value of 2.5% Mn is bolded above for reference. The data presented is a summary of the Mercator Geological Services Battery Hill Deposit Mineral Resource Estimate. A complete version will be posted to www.sedar.com within 45 days.

Qualified Persons

Mr. Harrington, P. Geo., of Mercator Geological Services Limited (Mercator) is responsible for technical disclosure in this press release regarding the Battery Hill Deposit Mineral Resource Estimate. Mr. Harrington is a qualified person (“QP”) as defined under NI 43-101 and both he and Mercator are fully independent of Manganese X Energy Corp., as also defined under NI 43-101.

This News Release has been reviewed and approved by Perry MacKinnon, P.Geo, Vice President of Exploration with Manganese X Energy and a “Qualified Person” as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Manganese X Energy Corp. at Emerging Growth Conference July 7, 2021 : 9:30 AM Eastern time

Manganese X Energy Corp., Martin Kepman CEO and Perry Mackinnon VP Exploration, will be presenting their Companies latest milestone at the Emerging Growth Conference July 7, 2021 : 9:30 AM Eastern time Please register here to ensure you are able to attend the conference and receive any updates that are released.

https://goto.webcasts.com/starthere.jsp?ei=1477114&tp_key=6d2d562bcc&sti=mnxxf

About Manganese X Energy

Manganese X’s mission is to advance its Battery Hill project into production, with the intent of supplying value-added materials to the lithium-ion battery and other alternative energy industries, The company is also striving to achieve new carbon-friendly more efficient methodologies, while processing manganese at a lower competitive cost. The company is moving toward commercialization of a manganese deposit in Canada.

Subsidiary Disruptive Battery’s mission is to develop an HVAC air purification delivery system for cleaner and healthier air, aiming to mitigate COVID-19 and other contaminants on surfaces and in the air.

For more information visit our website at www.manganesexenergycorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Martin Kepman

CEO and Director

martin@kepman.com

1-514-802-1814

Cautionary Note Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information in this press release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “potential”, “believe”, “intend” or the negative of these terms and similar expressions. Such forward-looking statements include, but are not limited to, the Company’s expectations about (i) the terms, and timing for the completion of, the Plan of Arrangement, and (ii) the timing of the receipt of the final order of the Supreme Court of British Columbia. Forward-looking statements necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements, including, without limitation, risks relating to (i) the social and economic impacts of the COVID-19 pandemic, (ii) the receipt of the requisite shareholder, court, regulatory and stock exchange approvals in connection with the Arrangement, and (iii) the Company’s business, including the mining industry in general, as described in the Company’s public filings on SEDAR. The foregoing list is not intended to be exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Readers are further cautioned that the assumptions used in the preparation of such forward-looking statements (including, but not limited to, the assumption that (i) the Company will satisfy, in a timely manner, all conditions precedent to completion of the Arrangement, (ii) all regulatory and stock exchange approvals will be obtained in a timely manner, and on terms acceptable to the Company, and (iii) the circumstances surrounding the COVID-19 pandemic, although evolving, will stabilize and will not materially impede or affect the ability of the Company to consummate the Arrangement), although considered reasonable by management of the Company at the time of preparation, may prove to be imprecise and result in actual results differing materially from those anticipated, and as such, undue reliance should not be placed on forward-looking statements. The forward-looking statements included in this press release are made as of the date of this press release and the Company does not undertake an obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws. Forward-looking statements, forward-looking financial information and other metrics presented herein are not intended as guidance or projections for the periods referenced herein or any future periods, and in particular, past performance is not an indicator of future results and the results of the Company in this press release may not be indicative of, and are not an estimate, forecast or projection of the Company’s future results. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Figure 1: Plan Map – Moody Hill and Sharpe Farm Zones